Leading measurement and analytics company Adjust released today The Shopping App Insights Report: 2025 Edition, revealing a strategic shift in how brands in Asia-Pacific (APAC) and across the globe are approaching user acquisition (UA). With AI and smarter targeting at the forefront, shopping apps are shifting from scale-focused approaches to ones that prioritize higher-value, more engaged users.

While e-commerce app installs declined 14% YoY globally in H1 2025, sessions increased 2%, indicating apps are attracting fewer but more engaged users. This trend is further evidenced by the global reattribution share for e-commerce apps – which increased 29% in H1 2025 over 2023 – signalling brands’ growing investment in re-engaging existing users rather than solely focusing on acquiring new ones.

APAC emerges as a key m-commerce growth engine

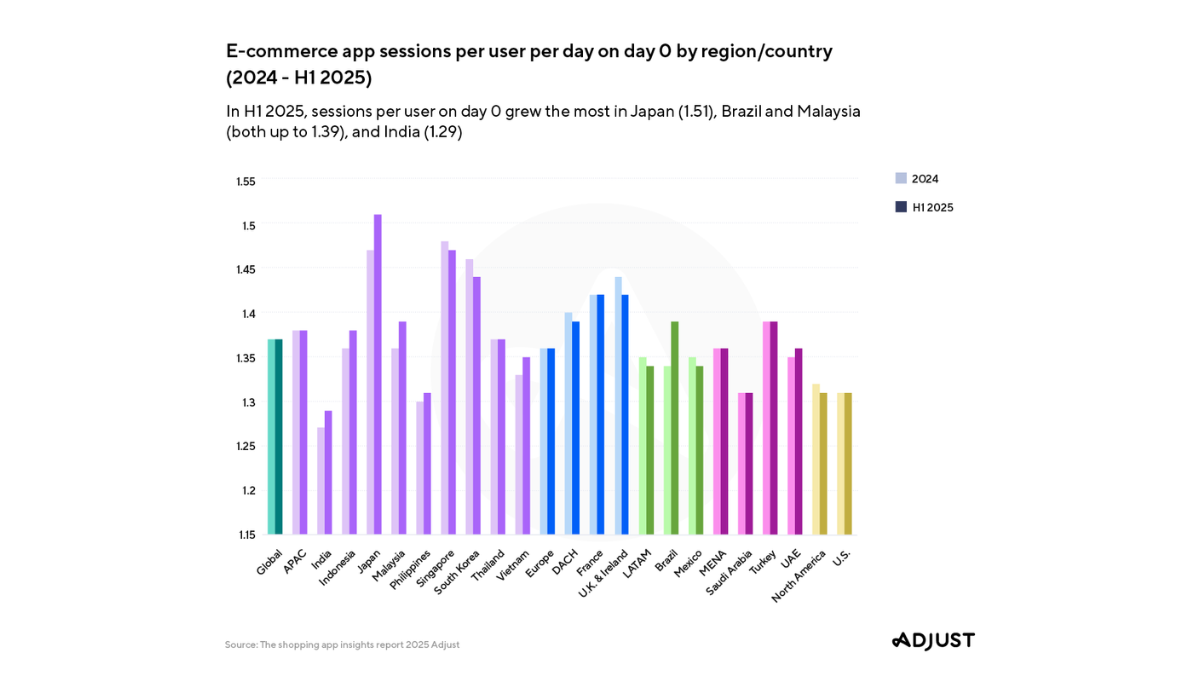

Adjust’s report reveals significant regional shifts in mobile commerce growth patterns. While mature markets like Europe, North America, and MENA experienced slowed growth due to saturation and shifting consumer behaviors, APAC led the way with a 13% increase in installs and a 2% rise in sessions YoY.

“Globally and across APAC, we are seeing a mobile commerce landscape that is not only growing, but is also maturing,” said April Tayson, Regional Vice President for INSEAU at Adjust. “The most successful shopping apps are those that blend AI-powered targeting with consistent, meaningful experiences across every touchpoint. This is where building trust and engagement that lasts well beyond the install comes in.”

Marketplaces winning user loyalty

Globally, shopping apps accounted for over three quarters of all e-commerce installs from 2024 to H1 2025, but generated just 36% of sessions, revealing a gap in sustained user engagement. Conversely, marketplace apps drove 60% of sessions, despite representing only 20% of installs. Session lengths for e-commerce apps also shortened in H1 2025, averaging 9.89 minutes– down from 10.23 minutes in 2024 globally – while marketplace apps posted the longest average of 10.69 minutes.

Marketplace apps also led with 25% Day 1 retention, while e-commerce apps dropped 13%.

Cost dynamics reflect market evolution

The global cost per install (CPI) for e-commerce apps reached $0.99 in Q1 2025, with shopping apps commanding $1.01 compared to marketplace apps at $0.89. Despite rising acquisition costs, click-through rates remained steady at 2% globally, suggesting consistent user engagement across channels.

Cross-platform integration drives omnichannel success

The report emphasizes the critical importance of seamless cross-platform experiences, with mobile web emerging as a high-intent entry point requiring frictionless web-to-app flows. Shopping apps averaged 7 partners per app in H1 2025, up from 6 in 2023, reflecting increased channel diversification strategies.

Legal Disclaimer: The Editor provides this news content "as is," without any warranty of any kind. We disclaim all responsibility and liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. For any complaints or copyright concerns regarding this article, please contact the author mentioned above.