The latest Knight Frank Alpine Property Report 2026 shows Europe’s Alpine property market continuing to outperform wider global luxury trends, with prime prices for alpine homes rising 23% on average over the past five years, fuelled by surging year-round demand, the rise of remote working, and a growing appetite for permanent mountain living.

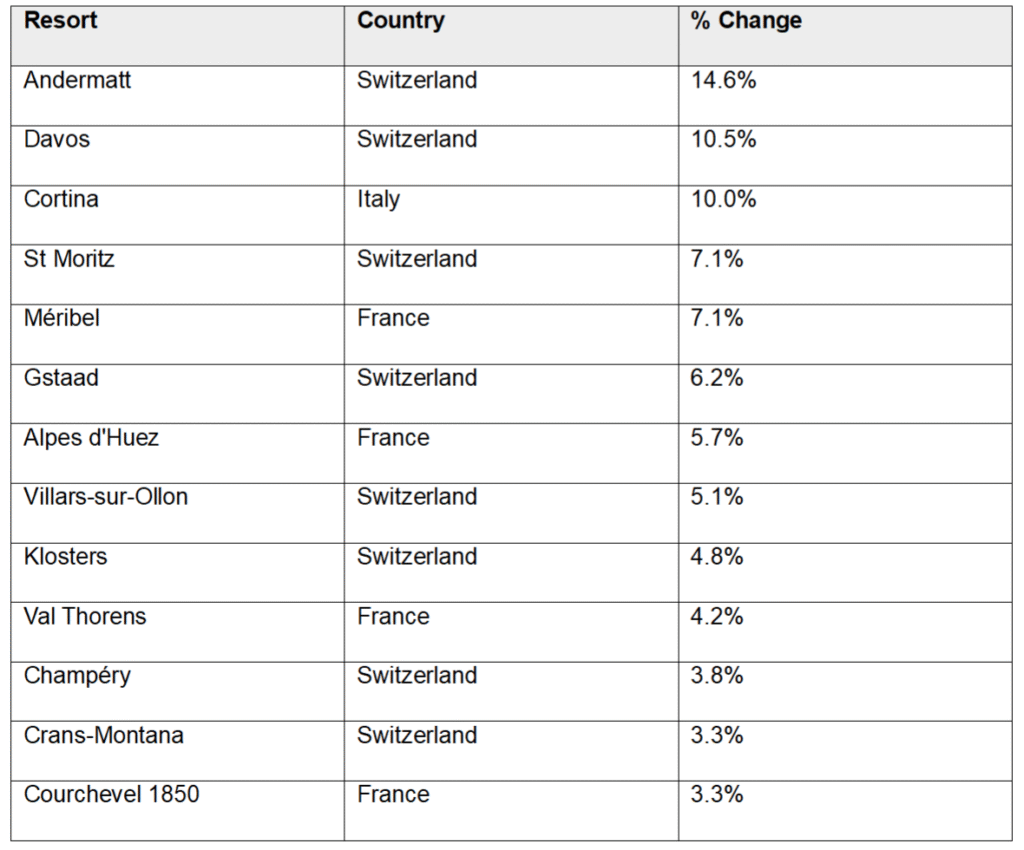

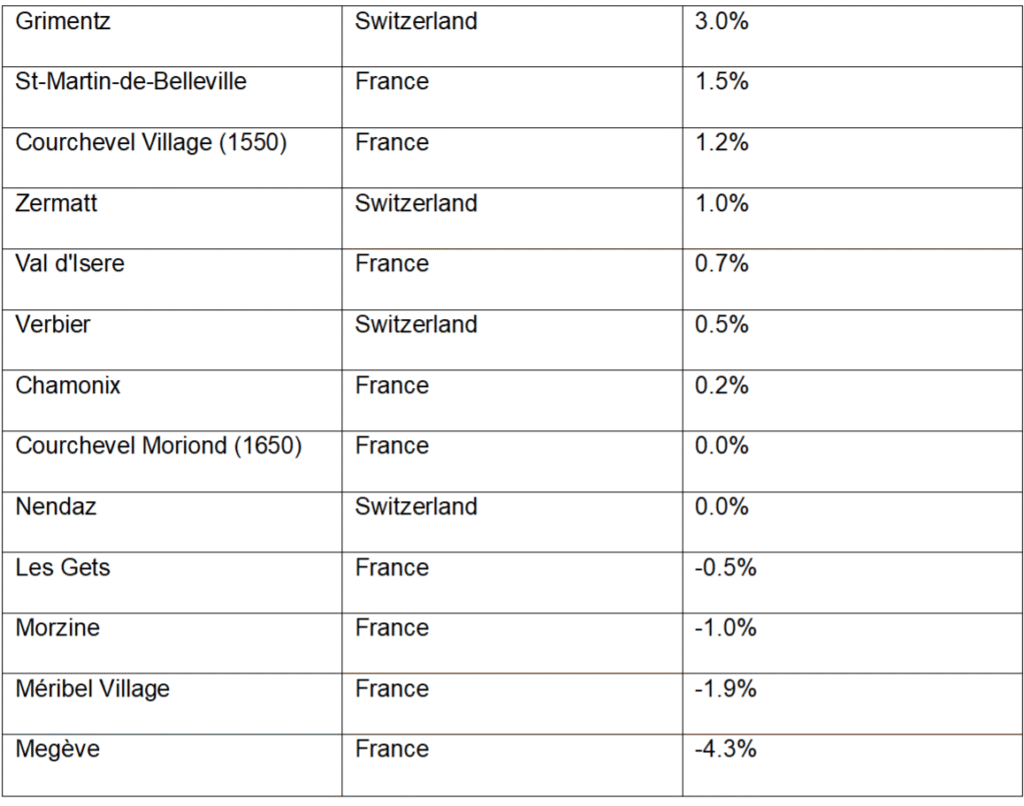

The Knight Frank Alpine Property Index rose 3.3% year-on-year, led by Andermatt (+14.6%), Davos (+10%) and Cortina d’Ampezzo (+10%), confirming the region’s resilience and growing international appeal. Overall, Swiss resorts outperformed French resorts in 2025. The average % price change in French resorts was 1.2% while in Switzerland it was 5%.

According to the report, 73% of high-net-worth individuals (HNWIs) surveyed would now consider living full-time in the Alps – a sentiment driven by flexible work lifestyles and a renewed focus on wellness, nature and community.

Key Takeaways

• Alpine property outperforms: The price of prime alpine homes is up 23% in five years, defying global luxury slowdowns.

• Cortina d’Ampezzo’s Olympic effect: Prices up 10% year-on-year ahead of the 2026 Winter Olympics, with values still 30–40% below St Moritz.

• Regulatory shake-up: Chamonix’s new “one out, one in” rule tightens supply and pushes premiums on properties with development rights.

• Sustainability in focus: Nearly half of buyers now factor climate resilience into purchase decisions, with Val Thorens, Val d’Isère and Zermatt leading Knight Frank’s Alpine Sustainability Index.

• Alpine living goes year-round: Lift pass sales up 46% in two years, confirming the Alps’ growing summer appeal.

• Costliest alpine destination: Gstaad, followed by St Moritz and France’s Courchevel 1850.

Kate Everett-Allen, Head of European Residential Research at Knight Frank, comments: “The Alpine property market has shifted from seasonal playgrounds to year-round sanctuaries. The surge in full-time residents, alongside rising summer tourism, is rewriting what it means to own in the mountains.

“While other luxury residential markets have plateaued, the Alps continue to deliver both lifestyle and long-term capital resilience. Regulatory shifts and the 2026 Olympics are creating new dynamics that investors cannot ignore.”

Dominic Heaton-Watson, Associate Director, International Residential, Knight Frank Property Hub said “The pandemic transformed mountain living from seasonal escape to permanent lifestyle. Now smart investors are capitalising on Europe’s resilient alpine destinations. This momentum is fuelled by shifting buyer priorities: summer tourism has surged in key markets; remote working has broadened the appeal of full-time mountain living; and new regulations are reshaping supply and demand dynamics”.

Additional Insights

· Millennials lead the charge – 80% say they would consider full-time Alpine living.

· Investment confidence remains strong – 92% of respondents are either very confident or somewhat confident about long-term value.

· Entry-level opportunity – 44% of HNWIs target homes under €2 million, proving the Alps are not only for ultra-high-net-worth buyers.

Knight Frank’s Alpine Property Index

Annual % price change year to June 2025. Source: Knight Frank Research. Note: The annual price change of a chalet in a prime location

Legal Disclaimer: The Editor provides this news content "as is," without any warranty of any kind. We disclaim all responsibility and liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. For any complaints or copyright concerns regarding this article, please contact the author mentioned above.