Prime rents remain firm; competitive costs and sustainable buildings draw regional interest

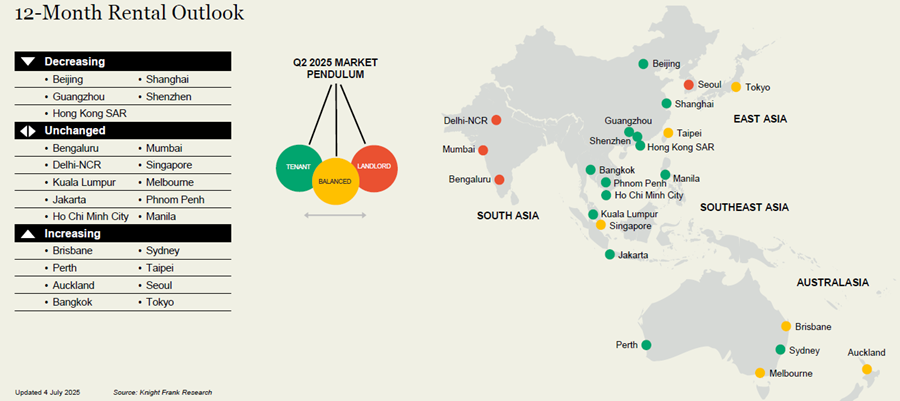

- Asia-Pacific Outlook: 18 of 24 monitored cities across Asia-Pacific recorded stable or rising prime office rents year-on-year in Q2 2025, reflecting resilience amid global headwinds.

- Vacancy Trend: Regional vacancy rates held largely steady, as tightening availability in India and parts of Southeast Asia helped offset the impact of over 1.4 million sqm of new supply across major markets.

- Kuala Lumpur Snapshot: Prime office rents in Kuala Lumpur averaged MYR 6.02 per sq ft per month, up 2.6% year-on-year and 0.2% quarter-on-quarter, with demand driven by flight-to-quality leasing in Grade A and ESG-compliant buildings.

- Local Market Outlook: While vacancy remains high at 23.4%, stabilisation and renewed interest in integrated, transit-linked developments suggest potential for a more balanced market over the next 12 months.

- Pipeline Pressure: New completions in 2025 are projected to add 2.4% to Kuala Lumpur’s office stock, reinforcing a tenant-favoured market and driving competition among landlords to secure quality occupiers.

KUALA LUMPUR, 24 JULY 2025 – Kuala Lumpur’s prime office market held steady in Q2 2025, supported by demand for premium, transit-connected and ESG-compliant buildings, according to Knight Frank’s latest Asia-Pacific Office Highlights report.

Prime office rents in the city centre averaged MYR 6.02 per sq ft per month, up 2.6% year-on-year and 0.2% quarter-on-quarter, reflecting resilience in a selective leasing environment. The market continues to favour occupiers, with landlords focused on retaining tenants and enhancing offerings to meet evolving workspace expectations.

“Demand continues to gravitate towards Grade A buildings with modern specifications and within integrated developments,” said Teh Young Khean, Senior Executive Director of Office Strategy and Solutions at Knight Frank Malaysia. “The market continues on a slow and steady trajectory, with a 1.2% improvement in vacancy rates and a 0.2% increase in rental compared to 1Q 2025.”

Kuala Lumpur’s Position in a Shifting Regional Landscape

In line with trends across Southeast Asia, leasing decisions are increasingly influenced by sustainability targets and portfolio consolidation strategies. Kuala Lumpur stands out for offering best-in-class office specifications at significantly lower occupancy costs than regional peers.

“Kuala Lumpur offers a compelling alternative for multinational firms re-evaluating their footprint,” said Keith Ooi, Group Managing Director of Knight Frank Malaysia. “As companies seek to optimise costs without sacrificing quality or ESG alignment, the city is well-positioned to meet those needs—at a fraction of the price of markets like Singapore or Hong Kong.”

Vacancy levels, while currently elevated at 23.4%, are showing signs of stabilisation. This reflects both the volume of legacy stock and the widening gap between older and newer assets in terms of tenant preference. Demand continues to concentrate in premium, well-connected developments.

Asia-Pacific Overview

Across the region, 18 out of 24 cities tracked by Knight Frank recorded stable or rising prime office rents year-on-year in Q2 2025. New supply added over 1.4 million sqm, but overall vacancy rates remained steady due to strong take-up in India and parts of Southeast Asia.

Looking Ahead

New completions are expected to add 6.8% to total office stock in Kuala Lumpur this year, sustaining a tenant-favoured environment in the near term. However, the city’s cost advantage—estimated at just USD 26.70 per sq ft annually—and continued infrastructure upgrades are expected to support its appeal to regional occupiers.

While rental growth may remain moderate due to supply pressures, the market is seeing a clear shift toward quality-driven leasing, where well-designed, ESG-ready offices in integrated hubs continue to outperform.

Regional Insights

Tim Armstrong, Global Head of Occupier Strategy and Solutions, says, “As global disruption becomes the status quo, occupiers are rethinking real estate not just as a place to work, but as a strategic platform for growth. They want flexibility to pivot with speed, functionality that supports evolving business models, and resilience built into every square foot to weather what’s ahead. Tenant activity for relocations is likely to remain modest as occupiers turn selective, shifting focus towards more holistic and dynamic strategies amid a flight-to-functionality.”

Download the report here: https://kf-my.com/KFAPAC-2Q2025-Office-Highlights

Legal Disclaimer: The Editor provides this news content "as is," without any warranty of any kind. We disclaim all responsibility and liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. For any complaints or copyright concerns regarding this article, please contact the author mentioned above.