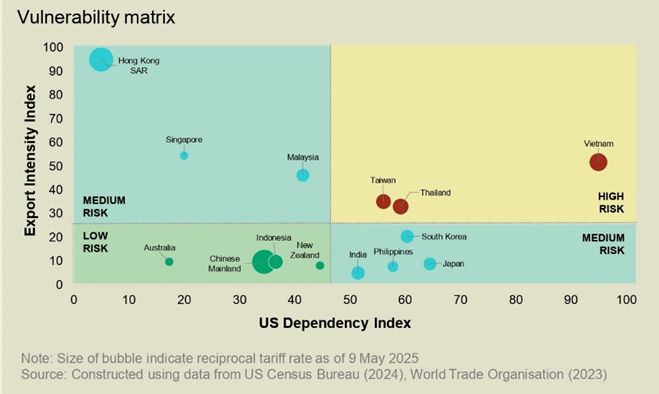

Kuala Lumpur – As trade tensions intensify and tariff policies grow more unpredictable, global corporations are re-evaluating their real estate strategies and Malaysia is emerging as a prime beneficiary. According to Knight Frank’s latest regional report, From Whiplash to Resilience: Corporate Real Estate in the New World Order, Malaysia is gaining investor confidence for its ability to provide cost-efficient, future-ready, and adaptable industrial real estate solutions.

The report highlights the global impact of wide-reaching tariffs introduced during the Trump administration, with effective rates on Chinese imports soaring up to 124.1% and impacting trade with over 57 countries. In response, multinational corporations (MNCs) are shifting away from speculative expansion toward operational resilience, favouring locations that offer clarity, agility, and built-to-suit solutions.

While regional peers like Vietnam and India continue to attract attention with their scale, Malaysia offers something increasingly critical in the current climate: strategic flexibility.

“In today’s fragmented trade landscape, Malaysia is proving attractive not because of bold moves, but because of its ability to offer reliable, purpose-built industrial solutions that align with the operational demands of modern businesses,” said Keith Ooi, Group Managing Director, Knight Frank Malaysia.

Knight Frank’s research points to a significant uptick in Chinese investment into Malaysia’s manufacturing sector, with inflows jumping from RM3.85 billion in 2017 to RM19.67 billion in 2018. This growth is being fuelled by manufacturers seeking supply chain diversification and a hedge against rising costs elsewhere. More recently, investor interest from China has seen a resurgence—attributed to high-level diplomatic engagements, including President Xi Jinping’s state visit. This has led to increased demand for customisable build-to-suit facilities that offer greater cost transparency, shorter lease terms, and tailored fit-out options. These qualities are increasingly favoured by occupiers in a post-pandemic world that demands real estate flexibility.

“Malaysia’s real estate market has quietly adapted,” adds Christine Li, Head of Research, Asia-Pacific, Knight Frank. “We’re seeing a shift from rigid 5-year lease terms to more agile, modular structures, especially in suburban industrial zones. These changes cater to SMEs and MNCs alike who are navigating unpredictable tariff regimes.”

Chart 1: Vulnerability Matrix – Regional Exposure to Trade Shifts

Source: Knight Frank analysis; US Census Bureau (2024); World Trade Organization (2023)

Policy support is another factor driving investor confidence. Initiatives like the Johor–Singapore Special Economic Zone (JS-SEZ) are aimed at fostering cross-border SME integration and improving logistics efficiency, reinforcing Malaysia’s positioning as more than a secondary option—it is increasingly seen as a strategic partner in regional economic realignment.

Although the broader macroeconomic climate remains cautious, Knight Frank’s assessment of Malaysia is one of “mixed with upside potential”—a sentiment shaped by the country’s stable fundamentals, supportive policies, and ability to absorb regional shifts in demand.

“Malaysia may not be the loudest player in the room, but its flexibility, policy clarity, and infrastructure-readiness are increasingly winning over global occupiers looking for long-term viability, not just short-term arbitrage,” said Tim Armstrong, Global Head of Occupier Strategy and Solutions, Knight Frank.

As global supply chains decentralise and the role of real estate evolves into a pillar of operational strategy, Malaysia’s capacity to provide fit-for-future, adaptable solutions may prove to be its most compelling competitive edge.

More on the insights here: Whiplash to Resilience – Corporate Real Estate in the New World Order

Legal Disclaimer: The Editor provides this news content "as is," without any warranty of any kind. We disclaim all responsibility and liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. For any complaints or copyright concerns regarding this article, please contact the author mentioned above.