Hong Kong – Standard Chartered Bank (Hong Kong) Limited (“Standard Chartered Hong Kong”)is proud to launch its new travel campaign, “Travel to the Fullest. Live Life to the Fullest.” Building on last year’s success, the campaign showcases how customers can seamlessly earn miles through integrated banking services, turning everyday transactions into rewarding travel opportunities. From Asia Miles Time Deposit and payroll to credit card spending and exclusive welcome offers, clients can maximize miles-earning potential and unlock premium travel experiences effortlessly.

Strategic Insights and Innovations Drive Seamless Integration of Miles and Banking

Standard Chartered Hong Kong has harnessed valuable insights from consecutive surveys conducted in 2024 and 2025, targeting high-net-worth individuals (HNWIs) to gain a deeper understanding of their travel preferences and behaviors. The 2024 survey highlighted a strong desire among affluent customers for dream vacations, identifying miles as a key tool in transforming these aspirations into reality.

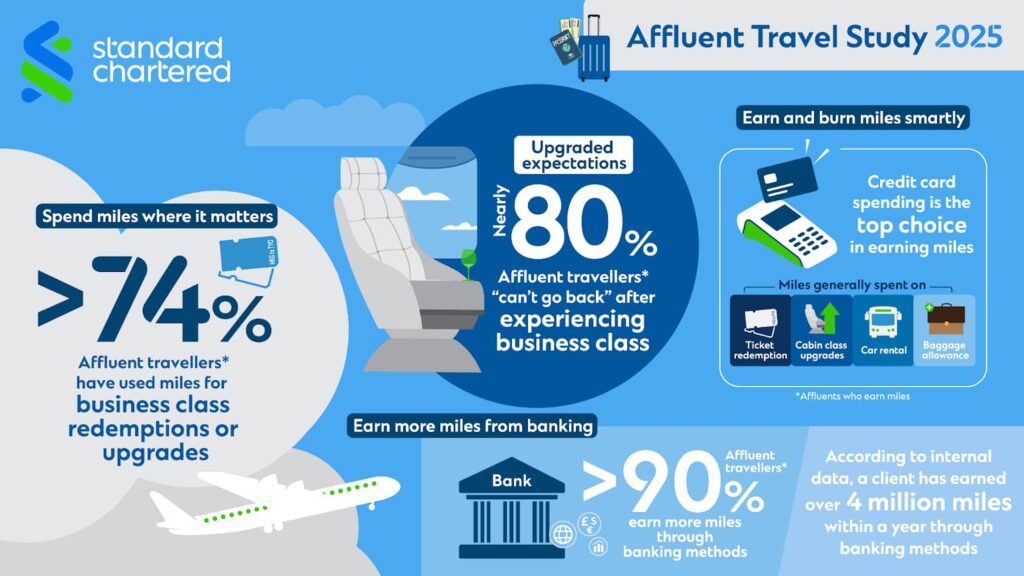

As this year’s campaign kicked off, insights were further expanded by the 2025 Travel Survey, which examined how affluent travellers strategically earn and use miles to elevate their travel experiences. It dispelled myths about luxury travel, highlighting how they use miles for business class upgrades, airport lounges, Michelin-starred restaurants, and five-star stays. Miles have become the new currency of luxury travel, with a shift toward fewer, more meaningful trips. By combining miles with integrated banking services, travellers unlock premium experiences that enrich their journeys.

Eliza Law, Head of Affluent Segment and Distribution of Standard Chartered Hong Kong, shared, “Our Priority Banking services are constantly evolving to meet the needs of the affluent clients who are eager to earn miles. The survey reveals that nearly half HNWIs have earned miles through banking services, such as setting up time deposits, payroll accounts, and wealth management. The number of affluent clients setting up Asia Miles Time Deposit with large deposits continues to rise, with some clients earning over 4 million miles within a year through banking services. Furthermore, earning miles through payroll accounts has become a new trend, allowing clients to easily enhance their next journey simply by receiving their salary.”

Multi-Platform Storytelling Transforms Mile-Earning for Discerning travellers

Beyond the insights gathered from the surveys, the campaign also focused on raising public awareness about the miles-earning banking journey, highlighting how banking services and miles can help travellers achieve their travel aspirations.

Firstly, a multi-channel marketing strategy seamlessly integrated paid media, social media, and influencer marketing to engage affluent travellers. Online ads, SEO, SEM, YouTube, MTR commercials, and ride-hailing app ads targeted HNWIs at key touchpoints, ensuring high engagement and recall.

Secondly, authentic storytelling played a pivotal role in this phase, featuring strategic collaborations with KOLs such as Alfred Hui, Tang Siu Hau, and Amy Lo. These renowned figures were carefully chosen for their smart spending habits and love for travel. Through their engaging stories, the campaign illustrates how savvy miles management can transform ordinary travel into extraordinary experiences, resonating with our audience’s desire for meaningful and transformative journeys. This approach not only enhances audience connection but also reinforces the campaign’s core message: optimizing travel through strategic mile-earning opportunities.

Lastly, Standard Chartered Hong Kong distinguishes itself through unique partnerships and promises that cater to affluent travellers seeking extraordinary experiences. Collaborations like TVB’s “Le Grand Tour de Liverpool”, chartered flights, and bespoke events with celebrities positioned Standard Chartered as the preferred bank for affluent travellers seeking exclusivity and sophistication.

Anshul Sabherwal, Head of Credit Card and Personal Loan at Standard Chartered Hong Kong, affirmed: “Standard Chartered is committed to maintaining its position as the preferred bank for wealth management and spending for HNWIs. We enable clients to earn more miles through comprehensive banking services and diverse products, along with the Cathay membership programme and its related services and offers. Last year, 40% of our clients redeemed miles for First and Business class tickets, demonstrating how clients effectively use miles to enhance their travel experiences. The much-loved Standard Chartered Cathay Mastercard has seen its issuance increase with a double-digit growth for two consecutive years, and it was recently awarded the ‘Best Credit Card Product for Travellers in Asia Pacific 2025,’ at the ‘Global Excellence in Retail Finance Awards,’ hosted by international financial media.”

To conclude, the “Travel to the Fullest. Live Life to the Fullest” campaign highlights Standard Chartered’s unique value proposition of seamlessly integrating banking services with miles earning. It offers an engaging and rewarding experience, reshaping perceptions of banking and miles. The campaign empowers customers to unlock fulfilling travel opportunities, reinforcing the bank’s commitment to making miles the essential currency for premium journeys.

For more information about the travel campaign, please visit Standard Chartered’s website.

To watch the campaign video, click here

Legal Disclaimer: The Editor provides this news content "as is," without any warranty of any kind. We disclaim all responsibility and liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. For any complaints or copyright concerns regarding this article, please contact the author mentioned above.