- In what specific ways are integrated payment solutions transforming the guest experience in hotels today—beyond just speed and convenience?

Luxury hospitality is no longer just about elegant accommodation and fine dining rooms. It’s about creating an effortless journey from arrival to departure. Integrated payment solutions are at the heart of this transformation. Doing more than saving time; they’re turning transactions into touchpoints for trust and personalization.

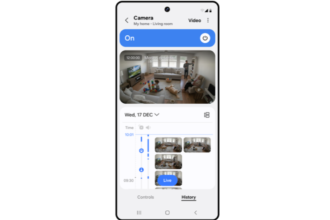

When a guest checks in after a long flight, instead of waiting while staff manually enter card details twice the payment terminal syncs directly with the PMS (property management system) – setting the stage for express check-out with no extra steps or queues. This automation eliminates errors and accelerates the process, but the real value lies in flexibility and confidence. Guests can also authorize a single amount at check-in and seamlessly apply it to in-room dining or spa treatments, avoiding multiple transactions.

For international travelers, features like DCC (Dynamic Currency Conversion), support for multiple card brands and local wallets make payments transparent and inclusive. Security remains paramount thanks to PCI DSS (Payment Card Industry Data Security Standard) compliance and sensitive data encryption.

As one hotel manager put it, “Payments used to be a friction point; now it’s part of the luxury experience.” Integrated solutions transform mere transactions into trust-building moments, reinforcing the brand promise of convenience and care.

2. With Global Payments’ recent partnership with a five-star hotel in Taiwan, what were some key challenges and learnings from implementing the Hotel Payment Gateway during a high-traffic festival season?

Global Payments partnered with five-star Regent Taipei to support its Christmas Market starting November 29, a period when the stakes were high – thousands of guests, festive crowds and a destination determined to deliver a flawless experience.

The challenge – Hotel Payment Gateway integration within the hotel’s core systems under a strict deadline. This meant connecting OPERA PMS, the property management system that handles reservations and guest profiles, with Simphony POS, the point-of-sale system used in restaurants, bars and any retail marketplace within the hotel premises. Doing this during peak season required precision and speed.

Upskilling front desk and F&B teams to adapt to new workflows became a top priority, while finance teams needed alignment for automated reconciliation – a game-changer during high-volume periods.

The key takeaway? Start early for planning and implementation, involve critical departments like finance for reconciliation planning and prepare contingency measures such as offline capture.

Despite the complexity, the outcome was outstanding: faster check-outs, fewer errors and a payment experience that matched the elegance of the Regent brand even during the busiest time of the year. As we like to say, technology elevated the season.

3. How do innovations like express check-out and PMS integration impact hotel operations behind the scenes, particularly in terms of staff efficiency, error reduction, and financial reconciliation?

Behind the scenes of a luxury hotel, payment processes can make or break operational efficiency. Express check-out and PMS integration are rewriting that story. By automating the flow of transaction data between payment terminals and the property management system, hotels eliminate manual keying while reducing errors and chargebacks. It’s like giving hotel staff back the gift of time.

Frontline teams are freed from repetitive administrative tasks and can focus on what truly matters: creating memorable and impeccable guest experiences. Finance teams also benefit significantly. Real-time reconciliation and automated reporting streamline audits and accelerate month-end closing, reducing reconciliation time from hours to minutes.

This isn’t just a technical upgrade – it’s a strategic shift. These innovations turn payments into a competitive advantage, ensuring accuracy, compliance and profitability while delivering peace of mind for both guests and operators. In short, it’s a perfect example of how back-office transformation drives front-of-house excellence, proving that smarter payments lead to elevated hospitality experiences.

4. Looking ahead to 2026, what role do you see payment providers playing in shaping the future of hospitality—and how should hotels in Asia prepare to stay competitive in this digital-first landscape?

By 2026, payment providers will evolve from transaction processors to experience enhancers. The future of hospitality payments is about integration and invisibility, where technology works quietly behind the scenes to enhance every guest interaction. Payments will connect seamlessly with loyalty programs, digital identity and personalized offers, thus creating journeys that feel natural from booking to check-out. Embedded payment capabilities will make transactions almost disappear, blending into the stay rather than interrupting it.

Choice will be critical: alternative payment methods such as local wallets and cross-border solutions will become essential for attracting global travelers, as convenience and flexibility are now non-negotiable. Behind the scenes, AI will increasingly transform operations by automating reconciliation, detecting anomalies and strengthening fraud prevention. Advanced security measures like tokenization and biometric authentication will safeguard trust, while compliance and ESG reporting will shape strategic decisions.

For hotels across Asia, the roadmap is clear: modernize PMS integrations, enable omnichannel payment options, invest in staff training and measure impacts on guest experiences. In a digital-first world, payments aren’t just infrastructure. – they’re a competitive edge that enhances experiences and builds loyalty. The goal is simple: remove any friction between intent and purchase. In hospitality, that means making every payment part of the experience.

Those who embrace this shift will not only keep pace but set new benchmarks for guest experience and build stronger brand equity. And on this journey, Global Payments stands as a trusted partner that always stays ahead of the curve, working hand-in-hand with our clients to deliver secure, innovative solutions that elevate every stay.

Legal Disclaimer: The Editor provides this news content "as is," without any warranty of any kind. We disclaim all responsibility and liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. For any complaints or copyright concerns regarding this article, please contact the author mentioned above.